All Categories

Featured

Table of Contents

That commonly makes them a much more cost effective alternative for life insurance policy protection. Lots of individuals get life insurance policy protection to assist monetarily secure their enjoyed ones in instance of their unforeseen fatality.

Or you may have the option to convert your existing term insurance coverage right into a permanent policy that lasts the remainder of your life. Different life insurance coverage policies have prospective benefits and disadvantages, so it's crucial to comprehend each prior to you decide to buy a plan.

As long as you pay the costs, your beneficiaries will receive the survivor benefit if you pass away while covered. That said, it is essential to note that a lot of plans are contestable for 2 years which means coverage could be rescinded on fatality, ought to a misstatement be discovered in the application. Policies that are not contestable commonly have actually a graded death benefit.

What is Direct Term Life Insurance Meaning? How It Helps You Plan?

Costs are usually lower than whole life plans. You're not secured into a contract for the rest of your life.

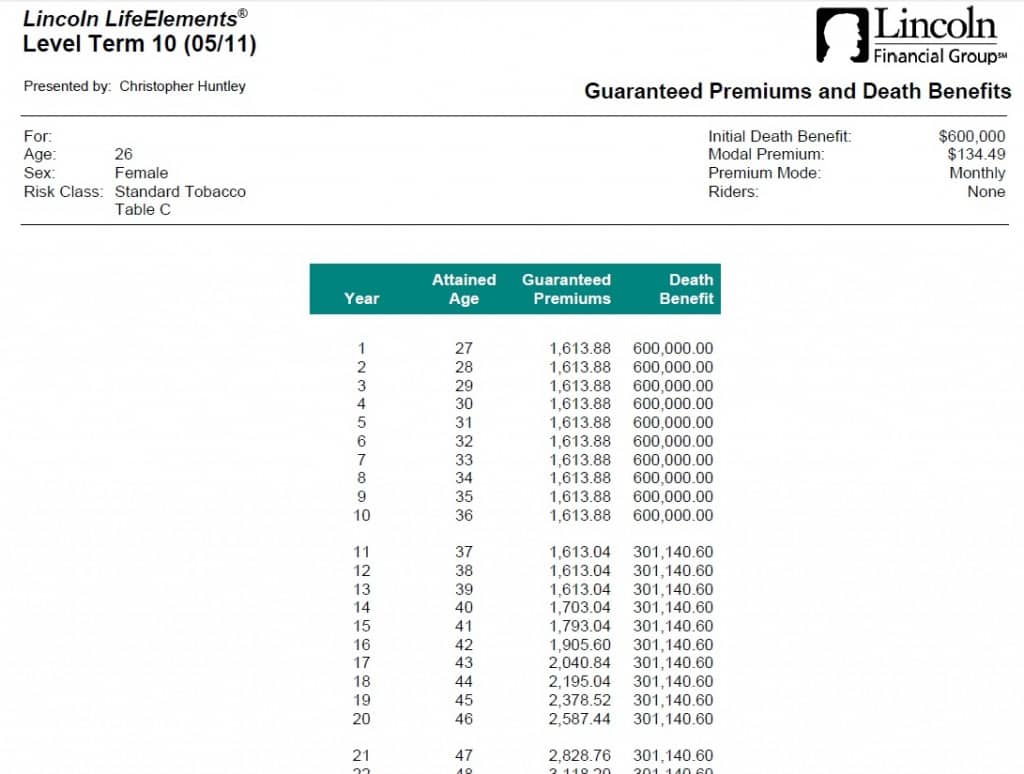

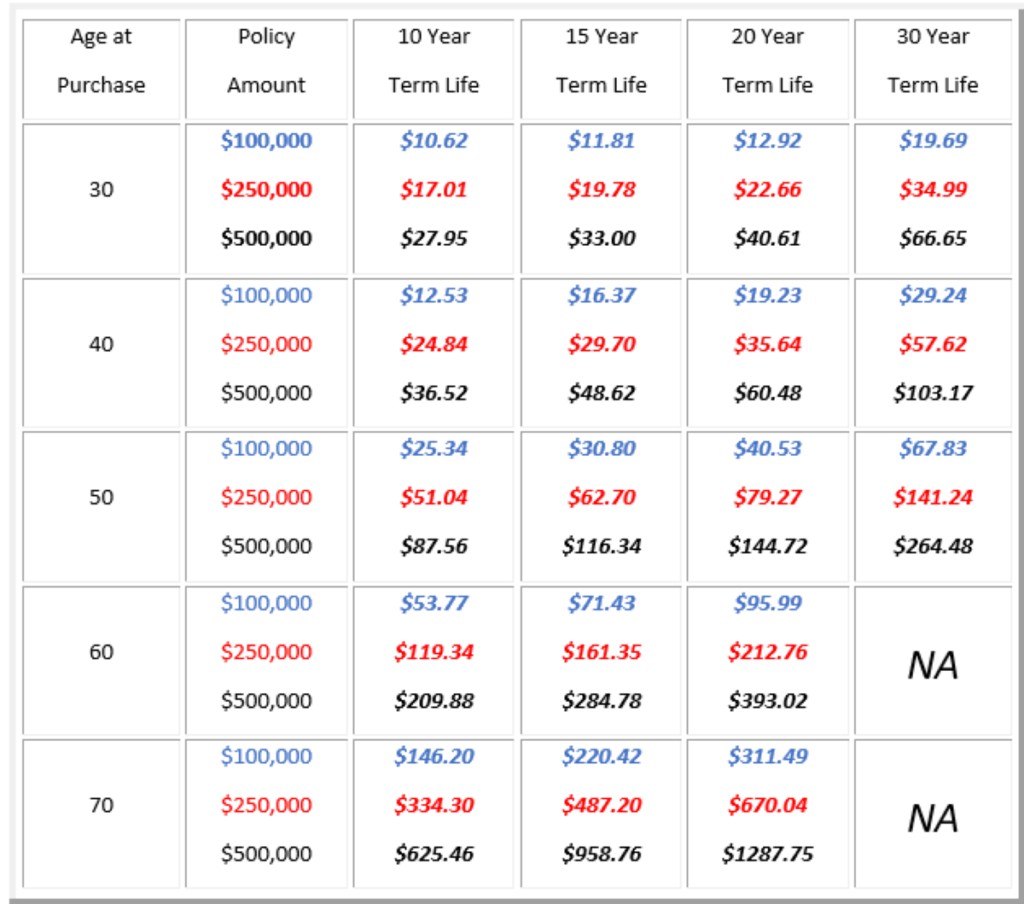

And you can't squander your plan during its term, so you won't receive any type of monetary take advantage of your previous coverage. Similar to other sorts of life insurance coverage, the expense of a level term policy relies on your age, coverage requirements, employment, way of life and wellness. Commonly, you'll find much more cost effective insurance coverage if you're more youthful, healthier and less risky to guarantee.

Given that degree term premiums remain the exact same for the period of insurance coverage, you'll recognize exactly how much you'll pay each time. Degree term protection also has some versatility, allowing you to customize your plan with extra attributes.

What Is Increasing Term Life Insurance? A Complete Guide

You might need to meet particular conditions and certifications for your insurance firm to enact this biker. In enhancement, there might be a waiting period of approximately 6 months prior to working. There additionally might be an age or time frame on the coverage. You can include a kid biker to your life insurance policy policy so it additionally covers your youngsters.

The fatality benefit is commonly smaller sized, and insurance coverage normally lasts up until your youngster transforms 18 or 25. This rider may be an extra affordable method to aid ensure your youngsters are covered as bikers can frequently cover multiple dependents at the same time. When your youngster ages out of this coverage, it may be possible to transform the motorcyclist into a brand-new policy.

The most typical type of permanent life insurance coverage is entire life insurance, yet it has some vital distinctions contrasted to degree term protection. Right here's a standard review of what to take into consideration when contrasting term vs.

How Do You Define 10-year Level Term Life Insurance?

Whole life entire lasts insurance coverage life, while term coverage lasts insurance coverage a specific period. The costs for term life insurance are usually lower than whole life insurance coverage.

Among the highlights of degree term coverage is that your premiums and your fatality benefit do not alter. With reducing term life insurance policy, your costs stay the same; nonetheless, the survivor benefit quantity gets smaller sized in time. You may have protection that begins with a death advantage of $10,000, which might cover a mortgage, and then each year, the death benefit will lower by a collection quantity or portion.

Due to this, it's often an extra economical type of degree term protection., however it might not be enough life insurance policy for your needs.

What is the Appeal of Term Life Insurance For Seniors?

After determining on a plan, complete the application. If you're authorized, authorize the documentation and pay your first costs.

You might desire to update your beneficiary information if you've had any type of substantial life adjustments, such as a marriage, birth or separation. Life insurance can sometimes really feel challenging.

No, degree term life insurance policy doesn't have cash money worth. Some life insurance policy policies have a financial investment function that allows you to develop cash money value gradually. A section of your premium repayments is alloted and can make passion gradually, which grows tax-deferred throughout the life of your protection.

You have some options if you still desire some life insurance policy protection. You can: If you're 65 and your coverage has run out, for instance, you may desire to purchase a new 10-year degree term life insurance policy.

What is Life Insurance Level Term? A Simple Breakdown

You may be able to convert your term protection into an entire life plan that will certainly last for the remainder of your life. Lots of types of degree term plans are convertible. That implies, at the end of your insurance coverage, you can transform some or every one of your policy to entire life coverage.

A level costs term life insurance policy strategy lets you stick to your budget plan while you assist secure your household. ___ Aon Insurance Policy Providers is the brand name for the brokerage firm and program management procedures of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Policy Providers Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc .

Table of Contents

Latest Posts

How Does Funeral Insurance Work

Group Funeral Cover

Final Expense Fund

More

Latest Posts

How Does Funeral Insurance Work

Group Funeral Cover

Final Expense Fund