All Categories

Featured

Table of Contents

They generally supply an amount of coverage for much less than long-term sorts of life insurance policy. Like any type of policy, term life insurance policy has advantages and disadvantages relying on what will certainly work best for you. The benefits of term life include price and the ability to personalize your term length and coverage amount based upon your requirements.

Depending on the kind of policy, term life can offer set costs for the entire term or life insurance coverage on degree terms. The fatality benefits can be fixed.

Renowned Which Of These Is Not An Advantage Of Term Life Insurance

Fees show plans in the Preferred And also Rate Course problems by American General 5 Stars My representative was really experienced and valuable in the procedure. July 13, 2023 5 Stars I was satisfied that all my demands were fulfilled promptly and properly by all the agents I spoke to.

All documents was electronically completed with accessibility to downloading for individual file maintenance. June 19, 2023 The endorsements/testimonials offered ought to not be understood as a recommendation to acquire, or an indication of the worth of any services or product. The testimonies are real Corebridge Direct clients that are not connected with Corebridge Direct and were not supplied settlement.

2 Expense of insurance coverage prices are established making use of methods that vary by business. It's vital to look at all elements when examining the general competition of prices and the worth of life insurance protection.

Premium Term Life Insurance For Couples

Like the majority of team insurance policy plans, insurance coverage policies offered by MetLife contain certain exemptions, exceptions, waiting periods, decreases, constraints and terms for keeping them in force (what is level term life insurance). Please contact your advantages administrator or MetLife for costs and full details.

For the a lot of part, there are two sorts of life insurance policy intends - either term or permanent plans or some combination of the two. Life insurers use different types of term plans and conventional life plans as well as "interest delicate" items which have become more common since the 1980's.

Term insurance policy provides security for a specified time period. This period might be as brief as one year or provide insurance coverage for a details variety of years such as 5, 10, two decades or to a specified age such as 80 or in some cases approximately the oldest age in the life insurance death tables.

Family Protection The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

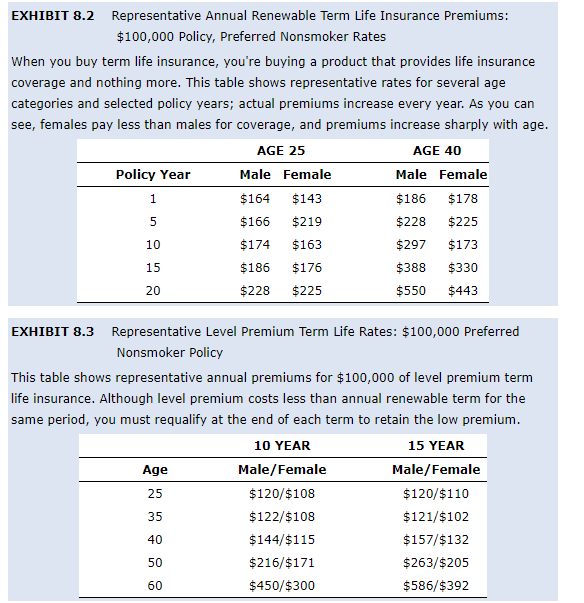

Presently term insurance rates are really affordable and amongst the most affordable historically experienced. It must be noted that it is an extensively held belief that term insurance policy is the least pricey pure life insurance policy protection readily available. One requires to assess the plan terms very carefully to make a decision which term life alternatives are suitable to meet your certain conditions.

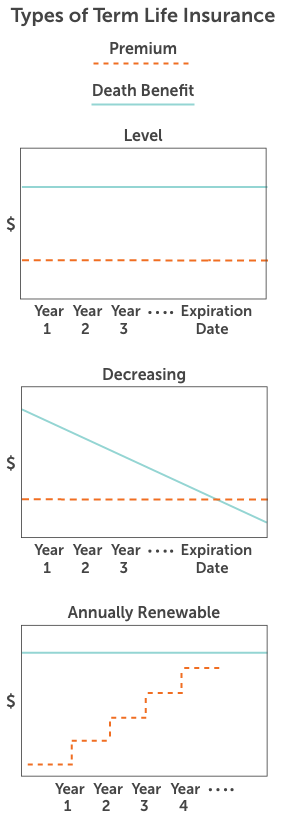

With each new term the premium is increased. The right to restore the plan without proof of insurability is a crucial benefit to you. Otherwise, the threat you take is that your health and wellness may deteriorate and you might be incapable to acquire a policy at the very same rates or perhaps in all, leaving you and your beneficiaries without coverage.

The size of the conversion period will differ depending on the kind of term plan purchased. The premium price you pay on conversion is normally based on your "existing achieved age", which is your age on the conversion date.

Under a degree term plan the face amount of the plan continues to be the very same for the whole duration. With decreasing term the face amount lowers over the period. The premium remains the same yearly. Commonly such plans are offered as home loan protection with the amount of insurance policy decreasing as the balance of the home mortgage decreases.

Typically, insurance companies have not had the right to transform premiums after the policy is sold (what is direct term life insurance). Because such policies may proceed for years, insurance firms should use conventional death, interest and expenditure price price quotes in the costs computation. Adjustable costs insurance coverage, however, allows insurers to provide insurance at reduced "current" premiums based upon less conservative presumptions with the right to transform these premiums in the future

Guaranteed What Is Voluntary Term Life Insurance

While term insurance is created to supply defense for a defined amount of time, irreversible insurance is created to offer insurance coverage for your whole life time. To keep the premium rate degree, the costs at the more youthful ages exceeds the actual cost of security. This additional costs constructs a get (cash worth) which assists pay for the policy in later years as the price of protection rises above the premium.

Under some plans, costs are needed to be paid for an established number of years. Under various other plans, premiums are paid throughout the insurance policy holder's life time. The insurance provider invests the excess premium bucks This type of policy, which is in some cases called cash value life insurance policy, produces a cost savings component. Cash money values are important to a permanent life insurance policy policy.

Leading Term Vs Universal Life Insurance

In some cases, there is no correlation in between the dimension of the cash worth and the premiums paid. It is the money worth of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Standard Ordinary Death Table (CSO) is the present table used in calculating minimal nonforfeiture values and policy gets for ordinary life insurance coverage plans.

Many irreversible policies will certainly contain provisions, which specify these tax requirements. There are 2 fundamental groups of long-term insurance policy, standard and interest-sensitive, each with a variety of variations. On top of that, each classification is usually readily available in either fixed-dollar or variable form. Conventional entire life policies are based upon long-term quotes of expenditure, passion and death.

If these estimates alter in later years, the business will readjust the costs as necessary however never ever over the maximum guaranteed premium stated in the plan. An economatic entire life plan provides for a fundamental amount of taking part entire life insurance policy with an additional supplementary coverage provided through the usage of rewards.

Since the premiums are paid over a much shorter period of time, the premium settlements will certainly be greater than under the whole life strategy. Single costs whole life is restricted payment life where one large premium payment is made. The plan is totally compensated and no more premiums are required.

Table of Contents

Latest Posts

How Does Funeral Insurance Work

Group Funeral Cover

Final Expense Fund

More

Latest Posts

How Does Funeral Insurance Work

Group Funeral Cover

Final Expense Fund